Finest Places to Order Cryptocurrencies: A Contrast of Popular Exchanges

Checking Out the Benefits and Dangers of Spending in Cryptocurrencies

The landscape of copyright financial investment is defined by a complicated interplay of engaging advantages and significant dangers. While the appeal of high returns and profile diversification is luring, prospective capitalists have to browse inherent difficulties such as market volatility and regulatory obscurities. Comprehending these characteristics is vital for anybody thinking about entrance right into this volatile sector. As we even more check out the subtleties of copyright financial investment, it ends up being obvious that notified decision-making is vital; nevertheless, the inquiry remains: Exactly how can financiers efficiently balance these benefits and threats to safeguard their monetary futures?

Understanding copyright Essentials

As the electronic landscape develops, understanding the essentials of copyright ends up being important for possible financiers. copyright is a form of electronic or digital currency that utilizes cryptography for safety, making it challenging to copyright or double-spend. The decentralized nature of cryptocurrencies, commonly constructed on blockchain modern technology, improves their safety and transparency, as deals are tape-recorded throughout a distributed journal.

Bitcoin, created in 2009, is the initial and most widely known copyright, yet countless choices, called altcoins, have actually emerged given that then, each with one-of-a-kind functions and purposes. Financiers need to familiarize themselves with vital concepts, consisting of wallets, which keep personal and public tricks required for purchases, and exchanges, where cryptocurrencies can be bought, offered, or traded.

In addition, understanding the volatility related to copyright markets is crucial, as costs can vary dramatically within short periods. Regulative factors to consider also play a considerable duty, as various countries have differing positions on copyright, impacting its use and acceptance. By comprehending these fundamental elements, prospective financiers can make educated decisions as they browse the intricate globe of cryptocurrencies.

Key Benefits of copyright Investment

Purchasing cryptocurrencies provides a number of engaging advantages that can draw in both amateur and seasoned investors alike. Among the main advantages is the possibility for significant returns. Historically, cryptocurrencies have displayed exceptional rate admiration, with very early adopters of properties like Bitcoin and Ethereum understanding substantial gains.

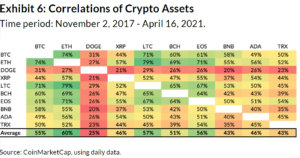

An additional trick advantage is the diversity opportunity that cryptocurrencies offer. As a non-correlated possession class, cryptocurrencies can serve as a hedge against traditional market volatility, permitting capitalists to spread their risks across various financial investment lorries. This diversity can improve general portfolio efficiency.

In addition, the decentralized nature of cryptocurrencies uses a degree of autonomy and control over one's assets that is often doing not have in standard financing. Financiers can manage their holdings without middlemans, possibly minimizing fees and increasing openness.

Furthermore, the growing approval of cryptocurrencies in mainstream financing and business additionally solidifies their worth suggestion. Lots of companies currently approve copyright payments, leading the means for more comprehensive adoption.

Lastly, the technical innovation underlying cryptocurrencies, such as blockchain, offers chances for investment in arising industries, including decentralized money (DeFi) and non-fungible tokens (NFTs), enriching the financial investment landscape.

Major Dangers to Consider

Another vital danger is governing uncertainty. Federal governments around the world are still creating policies concerning cryptocurrencies, and adjustments in policies can substantially affect market characteristics - order cryptocurrencies. An unfavorable regulative setting could limit trading and even result in the prohibiting of specific cryptocurrencies

Protection risks likewise posture a significant risk. Unlike typical financial systems, cryptocurrencies are vulnerable to hacking and scams. Capitalist losses can take place if exchanges are hacked or if exclusive tricks are endangered.

Lastly, the lack of consumer defenses in the copyright space can leave capitalists vulnerable - order cryptocurrencies. With limited recourse in case of fraudulence or theft, people may find it challenging to recover lost funds

Taking into account these threats, comprehensive research study and danger evaluation are this essential before involving in copyright financial investments.

Methods for Effective Spending

Developing a durable approach is necessary for navigating the complexities of copyright investment. Investors should start by carrying out extensive research to recognize the underlying modern technologies and market characteristics of numerous cryptocurrencies. This includes staying educated regarding fads, regulative developments, and market view, which can substantially influence property efficiency.

Diversification is an additional essential strategy. By spreading out investments throughout multiple cryptocurrencies, capitalists can reduce threats connected with volatility in any solitary asset. A healthy portfolio can supply a buffer versus market fluctuations while improving the potential for returns.

Setting clear investment objectives is crucial - site order cryptocurrencies. Whether going for short-term gains or lasting wide range buildup, specifying certain objectives helps in making educated decisions. Carrying out stop-loss orders can likewise secure investments from significant downturns, permitting a regimented departure method

Lastly, continuous surveillance and reassessment of the financial investment strategy is crucial. The copyright landscape is dynamic, and routinely reviewing performance against market problems ensures that investors stay dexterous and receptive. By sticking to these approaches, investors can improve their possibilities of success in the ever-evolving globe of copyright.

Future Trends in copyright

As investors refine their techniques, comprehending future fads in copyright comes to be increasingly crucial. The landscape of electronic money is advancing swiftly, affected their website by technical advancements, regulatory developments, and shifting market characteristics. One significant trend is the rise of decentralized finance (DeFi), which aims to recreate traditional financial systems using blockchain technology. DeFi protocols are gaining traction, offering innovative financial items that can improve exactly how individuals involve with their assets.

One more emerging fad is the expanding institutional interest in cryptocurrencies. As firms and economic organizations adopt electronic currencies, mainstream acceptance is most likely to enhance, potentially bring about higher price security and liquidity. Furthermore, the assimilation of blockchain modern technology right into different industries tips at a future where cryptocurrencies function as a foundation for deals across markets.

Additionally, the regulative landscape is evolving, with governments looking for to create structures that balance technology and consumer defense. This regulative quality can promote a more secure investment setting. Finally, advancements in scalability and energy-efficient consensus devices will resolve worries surrounding deal rate and environmental influence, making cryptocurrencies more feasible for day-to-day use. Understanding these fads will be critical for capitalists seeking to browse the complexities of the copyright market efficiently.

Conclusion